The national cannabis market is on the upswing, and in recent years several states have passed legislation decriminalizing marijuana possession or usage, or even legalizing it outright. What started with cautious legislation enabling doctors to prescribe medical marijuana has cascaded into overwhelming consumer applause that continues to grow in tenor.

Let’s take a close look at some statistics governing the greater market in the country.

According to some demographic analyses, 48% and 17% of recreational sales of cannabis products went to millennial and Gen Z users, respectively. How about in terms of national support? Apparently, in 2019, over 68% of participants polled were in support of cannabis legalization. That is an overwhelming majority, and it only promises to grow.

What about total users as a percentage of the current population? That’s estimated to hover somewhere around 12% of the current population. Apparently, slightly more men are current users, than women, but in the past three years, reported usage among female consumers has grown, leveling out at around 48% of users, splitting the market nearly 50-50.

These figures break up the market into actionable cohorts, but what about the promise of growth? What are estimates for legal cannabis sales in the United States?

Well, of course, figures will vary according to your source, but according to some figures, legal growth has been surprisingly high, no pun intended. You wouldn’t expect such overwhelming support from most consumers in the country without a corresponding increase in growth. According to some figures, cannabis sales through 2020 grew explosively. Whether fueled by the pandemic, stay-at-home orders, or ballooning public approval, 2020 cannabis sales grew by 60% – 67%, to be exact.

In 2020, the estimated value of the cannabis market was about 18 billion dollars USD – and it was and has been growing.

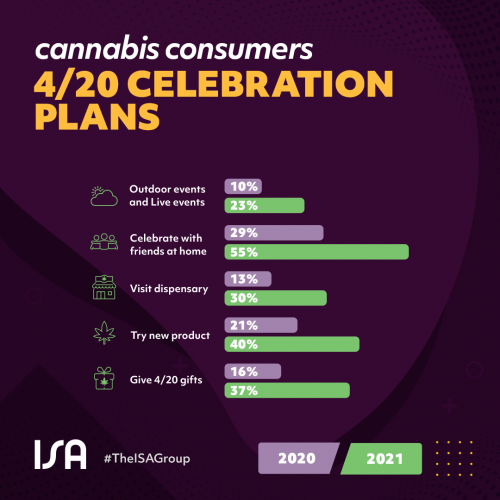

Now, how about consumer purchasing habits? What should we take a look at – frequency of use? Willingness to spend or budgetary considerations? Type of consumption method preferred? How about something else less predictable?

You’ll recall that many businesses were shut down during most of 2020. You may also remember – perhaps firsthand – that many people were forced to work from home or even, unfortunately, lost their jobs.

What else happened to cannabis consumer behavior during 2020, in addition to the fact that usage increased?

Well, buying habits shifted in a way that reflected similar changes in the greater market. Namely, consumers started relying on cannabis delivery services. Specifically, demand for cannabis delivery services inclined sharply. According to some figures, customer participation in cannabis delivery programs jumped by more than 50%.

That paints a picture for markets in which there were sellers that offered those services. Imagine what would have happened if all cannabis vendors offered those services? Likely, participation would have increased even further.

That being the case, not every vendor serves the same market – and since laws vary considerably from state to state, and since marijuana is still federally illegal, these national statistics might be of particular interest to most sellers operating from a specific state – which begs the question:

But What about Your Corner of the Industry?

The purpose of cannabis market research, specifically cannabis consumer statistics in California, is to learn as much as possible about your target customers. If you operate a cannabis dispensary, for example, in California, what consumers in Colorado or New York prefer may not matter too much to you. That solidarity might leave you with a warm fuzzy feeling, but in terms of actionable insights, there may not be much they can offer you.

This is why there is so much value in precision targeting and performing the right research, seeking the right answers – in the right places. Let’s consider some quick facts about the market for cannabis products in Califonia.

Cannabis Consumer Stats and Facts – California

- In 2017, cannabis sales in California accounted for 34% of legal sales in the United States.

- In 2020, California’s cannabis retail sales totaled around 4.4 billion dollars, up 50% from 2019.

- This figure accounted for 27% of all legal sales in the U.S.

- The cannabis market in California is expected to reach or exceed 5 billion dollars by 2022.

- California is the single largest legal market for cannabis products in the United States.

- According to some studies, around 20% of adults in California used cannabis recreationally in 2019, up from around 13% in 2011.

So does this mean it would be lucrative for you to invest in or open a dispensary in California? Are you currently employed by a dispensary and tasked with strategic growth?

The short answer is a resounding “possibly.”

Though the figures above are compelling in their own right, they are too raw to put to use for the purposes of devising strategic marketing positioning or making decisions about product research and development.

They just don’t paint a close enough picture about your own target consumers, perhaps because general statistics simply can’t do so. In order for you to effectively market your cannabis products, you need first to define your target audience, before a cannabis market research company in California can help you answer some of the following questions:

- How often do my target users use cannabis products?

- What types of cannabis products do they prefer to use?

- Are there any opportunities for marketing or developing new cannabis products? (Such as edibles, drinks, tinctures, etc.)

- What type of discretionary spending is my target market comfortable with?

- Do I need to start providing delivery services?

- Are there any seasonal trends I need to observe?

- Are there any product lines I should stop supporting or continuing?

- And many other similar questions.

If you’re looking for help making strategic decisions from a cannabis market research company in California, ISA Group can help. We offer a number of unique research products, including our bi-weekly CANNApinion surveys that can lend you tailored market insights to guide your strategic decision-making process.

Need a Cannabis Market Research Company in California?

You can’t answer questions until you ask them. Give us a call at 818-989-1044 or email us at hello@isacorp.com if you have any questions about how we can help you tailor your marketing strategy with custom insights.