The new era of cannabis will be driven by data.

This statement is not just a catchy tagline. It also describes the natural progression of a dynamic, diverse industry with unlimited growth potential.

In recent history, we’ve witnessed dramatic shifts in consumer behavior. The disruptions caused by Covid, the evolution of cannabis from illegal to “essential”, and the dismantling of stigmas have all contributed to a transformation of consumers’ relationships with cannabis. As a consumer insights firm, we’ve had the privilege of observing and measuring these monumental changes. Why not take a moment to pause and reflect on the experiences of 2021? This is by no means an exhaustive list of everything that happened in cannabis in 2021, but rather, just a few highlights related to marketing, branding, canna-business and of course, consumer data and insights.

To read our recap of 2020, check out this Ganjapreneur article – What we learned about cannabis consumers during the weirdest year ever.

State markets to watch in 2022

First up, the legal landscape looked a lot different in 2021. In 2020, we saw perceptions of cannabis shift dramatically when dispensaries were deemed essential businesses. In 2021, the momentum continued. A whopping 5 new states came online for adult use in 2021. The most exciting markets we’re watching closely in 2022 include New York, which some say could become the largest U.S. state market. Colorado continues to break sales records and is home to dozens of innovative brands. Of course, we can’t overlook our home state of California, which is developing a robust tourist destination with spas, cannabis agricultural tours and cannabis-friendly lodging.

Related articles

The Benefits of Hiring a Partner to Gather Cannabis Consumer Data in Colorado

If you’re reading this, you probably already operate a cannabis business in Colorado or you are considering investing in one.

Can a Cannabis Market Research Company in California Guide Strategy?

The national cannabis market is on the upswing, and in recent years several states have passed legislation…

Bud and Booze Sign a Truce

After months of marketing campaigns deriding the effects of alcohol and promoting cannabis as a healthy alternative, Hollywood’s favorite beverage brand, Cann, ended their unofficial war on booze by launching a series of partnerships with alcohol brands. The topic of hangovers was notably absent in Cann’s 2021 holiday ad, featuring Kate Hudson and Kate Hudson’s vodka brand King St.

Why the sudden change?

ISA’s study of beverage consumers from 2021 revealed that consumers are not necessarily looking for an alcohol replacement, and 40% of cannabis beverage consumers say that when they drink cannabis, they’re also drinking alcohol. If you’re a cannabis beverage brand, it makes sense to pivot away from a marketing strategy that could potentially alienate 40% of the market.

Anti-alcohol rhetoric is so 2020.

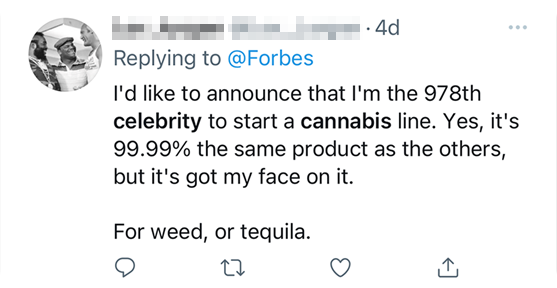

Celebrities Crowd into the Cannabis

Market - Consumers yawn

Speaking of celebrities…

Seth Rogan, Justin Bieber, Pitbull, DJ Khaled, Lil Kim, Ice Cube, Melissa Etheridge, Drake, Bella Thorne – this is only a partial list of the celebrities who announced their foray into cannabis in 2021. It’s obvious that some partnerships between brands and celebs are a natural fit, and the wave of celebrity entrants is a good indicator of growing cultural acceptance. For most consumers, however, it’s just adding to the clutter. This Twitter user is over it.

How many consumers share this guy’s opinion? A lot. Last year we partnered with mg Magazine to understand the luxury cannabis market and how consumers define luxury for cannabis products. We asked 1,000 cannabis consumers to rate how important a celebrity endorsement is for them when evaluating products. The majority (56%) said it’s of little importance or not important at all.

Marketing professionals have limited options when it comes to promoting cannabis online. Facebook and Instagram are famous for shutting down accounts, often without so much as an explanation. LinkedIn is cannabis-friendly, but the business-forward platform can be a turn off for those who appreciate the subversive, counter-culture characteristics of the industry.

Enter Clubhouse. In 2021, the censorship-free audio-based networking app exploded in popularity and cannabis entrepreneurs found a safe space to promote their products, discuss business, and network.

Cannabis in the Metaverse (Cannaverse?)

In December of 2021, Higher Life CBD grabbed headlines with a promotion that allowed customers to browse and buy cannabis products in the metaverse and then have it delivered to their real-world homes.

Some say it will take years or even decades for the metaverse to reach a point of critical mass, where it really takes off and regular people start to spend their free time shopping, socializing, and gaming on the new platform. However, cannabis people are not regular people. The words pioneer, subculture, experimental and “not risk averse” come to mind. It stands to reason that the same group that was first in line to seize opportunities in cannabis will also be early entrants in the digital “Wild, Wild West.” The cannabis business leaders who survived and thrived through Prohibition, constantly shifting regulations, natural disasters, supply chain issues and a global pandemic are battle-tested, and well poised to gamble on a new platform and win. Also, they know how to throw a party, so there’s that.

The Birth of Weed Week

Speaking of industry gatherings, 2021 also brought us the return of live, in-person cannabis networking events. After canceling their live event in 2020 (along with the rest of the world) MJBiz Con triumphantly returned to the Las Vegas strip in 2021 for their 10th annual show. This time there was something different. A new event called MJ Unpacked opened up down the street and kicked off the same day that MJBiz Con wrapped up. MJ Unpacked caters exclusively to brands and retailers. Ancillary businesses are not allowed. Is the fragmenting of events a cause for alarm or a natural progression? Some say the addition of MJ Unpacked means we can now look forward to a yearly mega event in Las Vegas – unofficially dubbed Weed Week. See what industry insiders are saying about Weed Week.

Insights Take Center Stage

In the early stages of development as an industry, consumer preferences were often over-looked in the rush to bring products to market. There was a sense that any product would sell, and any product could make it onto retail shelves. Fast forward to 2022 – brands are more deliberate with their planning and attentive to their brand and what it represents. Specific, core audiences and usage occasions are no longer an afterthought in product development and marketing strategies.

In 2021, we saw more leaders embrace the need for insights and level-up their investment in research.

Related article:

There’s still a long way to go before cannabis catches up with major national brands, in terms of analyzing their customers’ behavior to uncover market opportunities. With federal legalization on the horizon, and further consolidation, it’s quickly becoming too risky to ignore fundamental questions related to brand health.

In 2022, more organizations will need to answer questions such as…

- What are our customers experiencing when they use our products/ visit our locations?

- How loyal are our current customers?

- Why have our lapsed customers moved on?

- How does our product address consumers’ underlying emotional needs?

- Are we optimizing the use of our customer data?

- Which product types or new state markets represent the greatest opportunities with minimal risk?

- How do we stay in front of trends?

- How can we create a customer feedback loop that informs new product development and/or helps us improve our current offering?