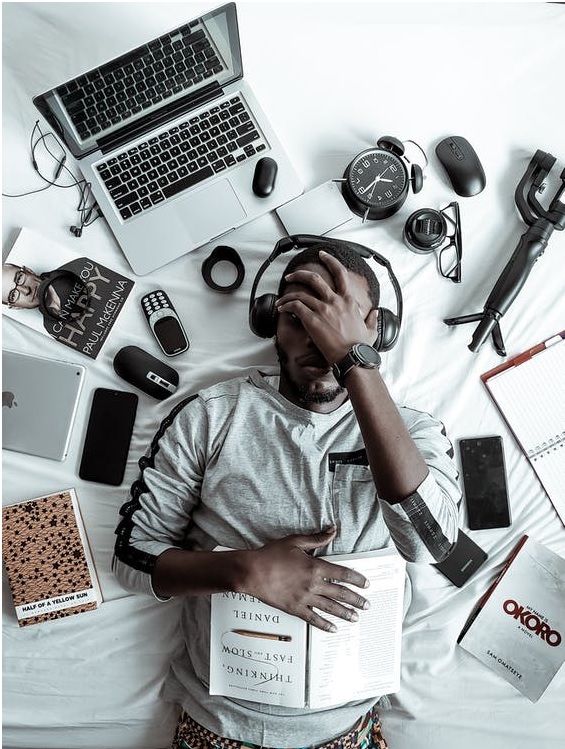

In the cryptocurrency market, just as in any investment market, nothing can be foretold with absolute certainty. Even the most conservative of investments come with some risk.

But cryptocurrencies, being so new, unregulated, and potentially volatile, are widely seen as some of the riskiest investments of all.

Some investors have made massive sums of money by investing in certain cryptocurrencies like Bitcoin, Ethereum, and Solana – but that doesn’t come without risk.

Instead, risk can be mitigated by following news, listening to investor insights, and conducting cryptocurrency market research. You can’t eliminate risk, but you can arm yourself against it with knowledge.

Here are some of the recent market trends and headlines you should be aware of, along with some questions cryptocurrency market research can help you answer.

●The recent cryptocurrency crash has stifled many first-time investors.

Coinbase, the largest cryptocurrency trading exchange in the United States, recently saw a sharp drop in the price of its stock.

This sharp downturn has cost some investors quite a bit, but all is not necessarily lost. The crypto market has experienced slow periods before, and it’s likely to face them again.

The question is how far the values of cryptocurrencies will fall before they start to rise again, or whether slow performers will be replaced by new opportunities.

●The cryptocurrency market just fell below 1 trillion USD.

By November 2021, the global cryptocurrency market had risen to $2.9 trillion, after relatively fast growth and rapid gains.

However, for the first time since January 2021, the global market has fallen below $1 trillion.

Fluctuations in the market are to be expected, but the pace at which these changes have occurred is atypically quick.

Savvy investors should follow the old adage to “buy low, sell high,” making the current time a typically lucrative period for investment – assuming, only, that the market will rise again in the near future.

●It’s not all doom and gloom – some cryptocurrencies are gaining steam despite recent downturns.

Take, for example, Optimism, a layer 2 protocol cryptocurrency that despite recent losses in the past three months (and in line with most other cryptocurrencies) has risen consistently over the past month.

There are still opportunities for investors that know where to look, and what to look for.

Of course, investing in a cryptocurrency that is currently rising is not necessarily beneficial to the investor. It’s important to have the right information at hand before making any kind of investment decision.

These are the sorts of things that investors need to weigh carefully when eyeing potential transactions.

●The prices of cryptocurrencies can fluctuate drastically.

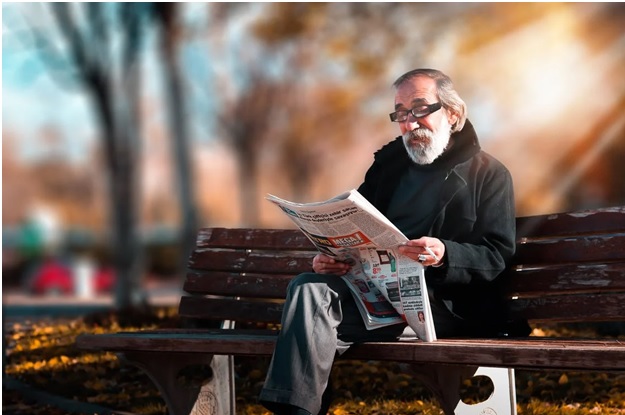

While recent headlines have focused mostly on losses and SEC investigations, if you read between the lines, you can see that there are many factors driving the overall growth of the cryptocurrency market.

Only a few years ago, cryptocurrency was a “cryptic” term (if you can excuse the pun). Today it is a household word, and investors are showing new interest. Rising ledger transparency and visibility are also driving interest and investor confidence.

That said, the novelty of the market and the lack of regulations can also result in rapid fluctuations in price.

●Despite recent losses in value, certain cryptocurrencies may be poised to experience growth in the upcoming months.

Consider Solana, one of the cryptocurrencies that has been affected by the recent bear market and has lost value in recent months.

Despite these cues, some investors are expecting Solana to grow through August, as they key in on what they call a “Bear Flag.”

The “Bear Flag” occurs during bear markets; it is a technical pattern that occurs when a factor driving the value of a currency gets resolved, allowing the value of the currency to rally.

Will the pattern repeat itself through the next forecast period?

No one can say with absolute certainty, but these are the sorts of patterns that cryptocurrency market research can help you develop an eye for.

How Can Cryptocurrency Market Research Help You (or Your Firm) Make Wise Investment Decisions?

The more you know about the financial institutions that deal in blockchain technology and digital assets like digital currencies, the better you will be positioned to make informed choices about crypto investments.

Cryptocurrency market research can shed some light on the following factors.

● Projected size of the market

Projects for CAGR (compound annual growth rate) for the cryptocurrency market vary according to the source of reports, ranging from about 7% on the low end to higher than 31% on the higher end.

Regardless, the global market is expected to grow drastically through the remainder of the 2020s and into the 2030s and is driven by the transparency of distributed ledger technology, a rise in demand, general growth in the use of cryptocurrencies as acceptable payment methods, and the low cost of electricity (used for crypto mining operations) in certain investing countries, like China.

● What different market dynamics will affect the cryptocurrency industry

There are numerous drivers affecting the global growth of cryptocurrency in key markets, such as North America (primarily the United States) and the Asia Pacific region (chiefly China and Japan).

Growing numbers of users and potential investors, improved transparency, expanding digital currency exchange platforms and facilities, and enhanced crypto mining machines and methods are key market dynamics influencing not only the value but the proliferation of cryptocurrencies.

● Major challenges for players in the cryptocurrency market

A wide range of challenges faces the cryptocurrency market.

One of the largest is the lack of official acceptance. Cryptocurrencies are not officially backed and therefore lack authority in the eyes of some investors. Also, they are not currently widely accepted as a medium of exchange (although merchants are warming up to them).

The uncertainty of the future regulations of the cryptocurrency market also causes some investors to shy from the prospect of investing with greater confidence. Many others have concerns about control, security, and fraudulent transactions.

Ready to Get Started Investing in Cryptocurrency Market Research?

No market research can entirely remove the aspect of the risk involved in investment, regardless of the market. However, wisely-funded cryptocurrency market research can help investors make informed strategic decisions about investments, when and what to buy, when to sell, and what prices to ask.

To get started putting together a customized plan for cryptocurrency market research, take a look through our services via the previous link or get in touch with us at Hello@ISACorp.com. Let us know about your goals and we’ll work out a specialized research plan for your organization.