States across the country have taken steps in the direction of cannabis legalization and decriminalization. Some states have legalized sales and; depending on the source you trust, as many as two-thirds or up to 68% of Americans believe that cannabis products and their associated consumption should be legalized. Consequently, the legal cannabis industry has consistently grown.

Whether you operate a successful dispensary and have been in business for years or you’re just looking into the financial implications of running one, there is value in cannabis consumer insights. Business leaders base much of their strategic planning around forecasts developed from extensive consumer opinion polling and other objective research.

But how can it benefit your business? Much of it comes down to how well you understand your consumers, what they do, why they do it, and what they want.

When historical sales data is insufficient, sometimes the answer lies with gathering the data proactively. Here are some of the key questions that cannabis consumer insights, consumer polling, and market research can help you answer.

How Do Customers Prefer to Buy?

Though this question, on the surface, looks like a high-level “cash or credit?” type of question, its implications run much deeper. Consider the shifts in purchasing habits that have taken place over the past two years or so.

More and more online and local shoppers are increasingly desirous of free shipping that is also stipulation-free; that is, customers who buy online want free shipping or free local delivery. Is your dispensary prepared to handle that?

For example, our research indicates that 33% of cannabis users in select markets relied heavily on delivery services during coronavirus lockdowns. Is that trend going to continue or will it falter? Past sales figures can’t tell you – only current polling and other research.

The bigger question is: is your dispensary poised to adapt to changing consumer preferences such as these?

What Are Customers Cannabis Consumption Habits?

Does your dispensary sell only flower? Or does it sell a range of different cannabis products, such as edibles, tinctures, concentrates, cannabis drinks or other unique products? More importantly, does this matter to your customers?

If your target buyer smokes flower, then you’re set for success. But what if your buyers only purchase flower incidentally, then decarb it themselves in order to make their own edibles? You might serve them better by expanding your product portfolio. Consumer data can yield insight into this consumer data.

Conversely, a product line expansion might be a wasted expense if it doesn’t result in sales and conversions. How and what your target buyers consume can help you grow strategically, making informed decisions that can justify that growth with sales – not just with a larger, costlier enterprise.

How Frequently Do Your Target Consumers Partake?

The prices you set and the type of buyer you want to attract will both affect and be affected by the consumption habits of your target market. Profitability will be affected by sales, and you might need to adjust prices accordingly to reflect projected sales forecasts.

As a very simple, high level, but reasonable example, if your target market only partakes occasionally, you might want to sell in larger or bulk quantities in order to meet that demand and expand profitability at the same time. Selling in smaller quantities might not make sense.

It all comes back to what your buyers do and when they do it – how often do your target consumers use cannabis, and can your dispensary meet that demand?

What Type of Budget Does Your Target Customer Set?

Similarly, you need to understand your target buyers’ budget as closely as possible. Other questions such as those related to price sensitivity are equally important to answer. If your branding appeals to a price-insensitive audience, a price scale or adjustment might be in order. The same could be said if your brand was not well-aligned with the actual visitors that came to your dispensary.

The key takeaway is that your price model might be inefficient, but you wouldn’t know it unless you can answer some key questions about how much your target audience intends to allocate to discretionary purchases of cannabis products.

What Types of Incentives Will Your Target Buyer Respond to?

Another basic but surprisingly relevant question revolves around strategic growth. It’s been shown time and time again that effective loyalty programs can improve customer satisfaction, boost customer engagement and retention, and increase sales. The operative word in that statement is “effective.”

What type of loyalty program will appeal to your target buyer? Why? What other strategic positioning incentives can you undertake in order to reach more consumers more effectively? Our consumer research shows that over 70% of dispensary shoppers would spend more if the dispensary offered a loyalty program.

What other questions about strategic growth do you need to be answered before you can justify the expense associated with rolling out new programs? You may be the only one to be able to ask those strategic questions, but our cannabis consumer insights can help answer them.

Basic Cannabis Consumer Insights: Your Buyer Persona

Reflect on what you’ve read so far. You’ll notice that we used the terms “target audience” and “target buyer” several times throughout this article. Before you can answer any of the other questions we posed with cannabis consumer insights, you need to define your target buyer – surprisingly, target buyers are not just the people that come into your dispensary to purchase. These are just buyers. Target buyers fit a profile defined by habits, preferences, and demographics that you must define in order to launch successful marketing campaigns.

Luckily, cannabis consumer insights can also help you define your target audience. To learn more about how you can get started making wiser marketing moves, visit our pages on Cannabis Market Research and CANNApinion Polling, or get in touch with us directly at 818-989-1044 or at hello@ISACorp.com.

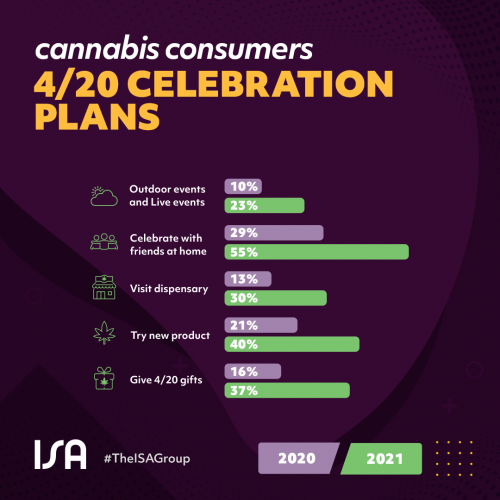

ISA’s company president, Jacqueline Rosales, has been featured in the San Fernando Valley Business Journal. In her interview, Rosales talks about where consumers are coming from post-pandemic: how the big shifts are centered around self-care and self-sufficiency tools. She believes consumers are really focused on the question of how am I going to do things at home?

ISA’s company president, Jacqueline Rosales, has been featured in the San Fernando Valley Business Journal. In her interview, Rosales talks about where consumers are coming from post-pandemic: how the big shifts are centered around self-care and self-sufficiency tools. She believes consumers are really focused on the question of how am I going to do things at home?